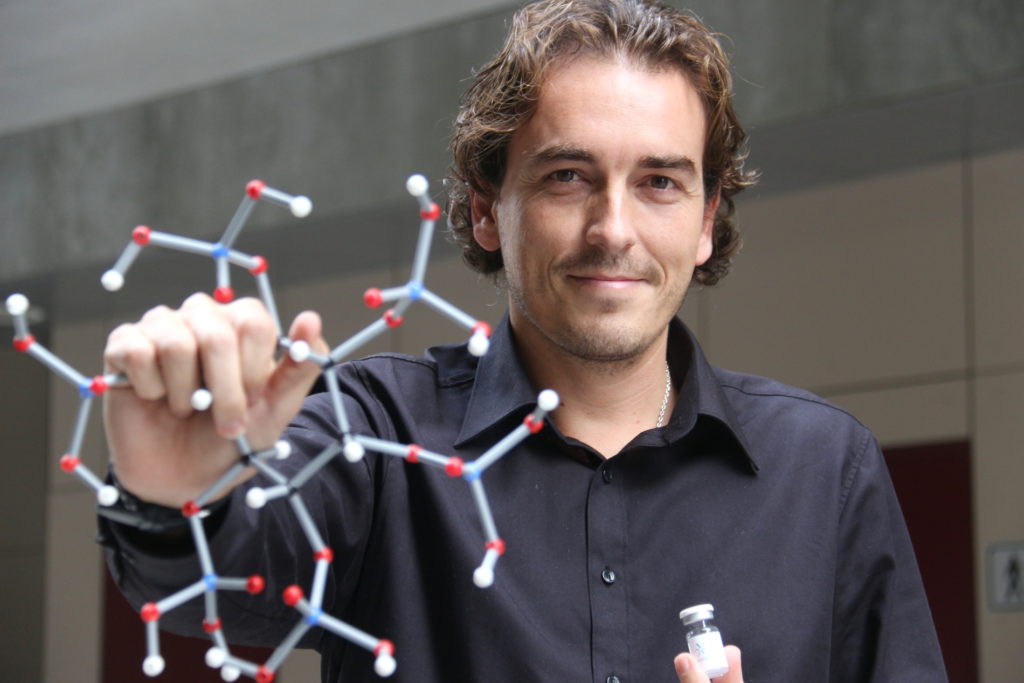

Joan Perelló, CEO of SANIFIT. Photo. UIB.

The Swiss company Vifor Pharma bought for 205 million euros the Mallorcan Sanifit, a biopharmaceutical company focused on treatments for progressive vascular calcification disorders.

The main compound in Sanifit, SNF472, is a novel stage 3 vascular calcification inhibitor, the first of its kind, developed for the treatment of calcific uremic arteriolopathy (CUA) and peripheral arterial disease (PAD) in patients with disease. end-stage renal disease.

Vifor Pharma will acquire 100% of the outstanding shares of Sanifit Therapeutics. It will receive full global rights to SNF472 and enhance the company’s portfolio of innovative assets.

“Through the acquisition of Sanifit and its lead compound SNF472, we will further expand our growing nephrology portfolio toward vascular calcification, a leading cause of morbidity and mortality in patients with end-stage renal disease. SNF472 is the only novel asset that addresses a large unmet medical need for end-stage renal disease patients with calcific uremic arteriolopathy and peripheral arterial disease. We look forward to bringing this highly promising and innovative treatment option to more than 330,000 patients in the US and Europe as soon as possible, “said Abbas Hussain, CEO of Vifor Pharma Group.

Joan Perelló, Ph.D., CEO of Sanifit, said: “From the beginning, Sanifit has pioneered new approaches to treating calcification disorders, a huge area of unmet need. This agreement is a testament to the enduring commitment of our dedicated team and investors, as well as our unique approach to combat vascular calcification, which originated at the University of the Balearic Islands. We are excited to join forces with Vifor Pharma, which has a world-renowned commitment to patient-centered cardio-renal therapies. Vifor Pharma is the ideal partner to drive the development of the Sanifit calcification franchise and bring these new treatments to patients as quickly as possible. ”

The closing of the transaction depends on customary closing conditions, including the FDI procedure in Spain and merger filings in certain countries, and is expected to take place in the first quarter of 2022.

Leave A Comment